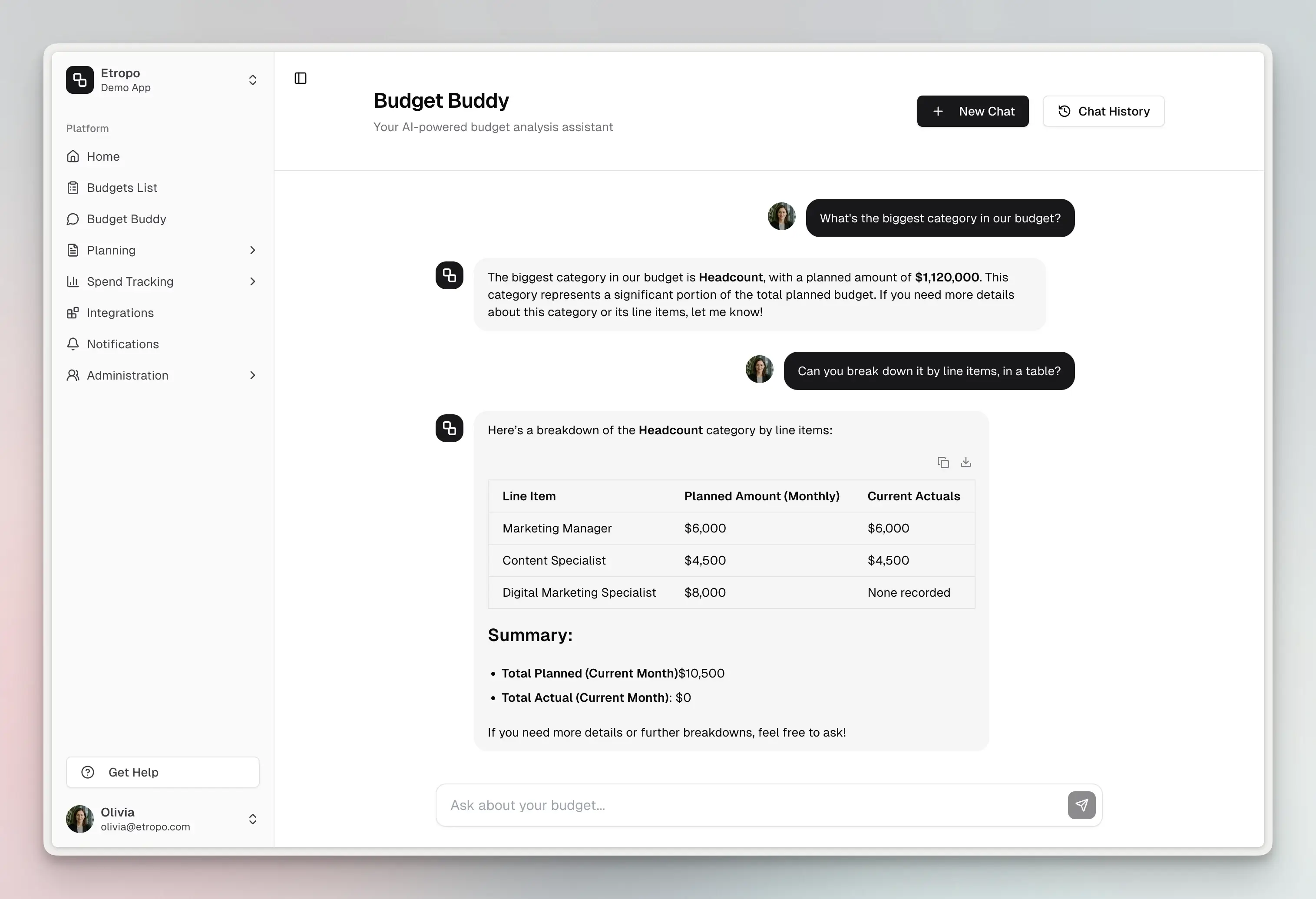

Budget Buddy: Your AI Budget Assistant

What is Budget Buddy?

Budget Buddy is an intelligent AI assistant built into Etropo - your budget management platform. Think of it as your personal finance expert that has complete access to your budget data and can answer questions, provide insights, and help you make better decisions for your marketing department.

Unlike generic chatbots, Budget Buddy understands your specific budget structure, spending patterns, and financial goals. It can analyze your data in real-time and provide personalized recommendations based on your actual financial situation.

It can help you answer questions raised by CEO and other stakeholders in your company by generating ready-to-share reports, tables and graphs.

How Budget Buddy Works

Smart Data Access

Budget Buddy has two ways to help you:

-

Quick Overview Responses: For general questions about your budget status, totals, or high-level comparisons, Budget Buddy uses your budget context data to give you instant answers.

-

Detailed Analysis: When you need specific information about individual expenses, vendors, or campaigns, Budget Buddy uses advanced tools to dig deep into your data and find exactly what you’re looking for.

Conversation Memory

Every conversation with Budget Buddy is saved automatically. You can:

- Start new chats for different topics

- Return to previous conversations

- See your complete chat history

- Pick up where you left off

What Budget Buddy Can Help You With

Quick Budget Insights

- Overall Status: “What’s my budget utilization this month?”

- Category Performance: “How much am I spending on performance marketing?”

- Monthly Trends: “Show me our spending trend over the last 3 months”

- Budget Health: “Are we on track with our budget goals?”

Detailed Analysis

- Specific Expenses: “What marketing campaigns are running this month?”

- Vendor Information: “Who owns the Google Ads budget?”

- Line Item Details: “Show me all our social media advertising expenses”

- Granular Breakdowns: “What are our biggest expenses in the operations category?”

Smart Recommendations

- Cost Optimization: Identify areas where you might be overspending

- Budget Adjustments: Suggestions for reallocating funds between categories

- Trend Analysis: Insights into your spending patterns over time

- Performance Reviews: Compare planned vs. actual spending

Key Use Cases

1. Quick Status Checks

Scenario: You’re in a meeting and need to know your current budget status. Example: “What’s our current budget utilization?” Result: Budget Buddy instantly provides your overall spending percentage, remaining budget, and key metrics.

2. Detailed Expense Investigation

Scenario: You notice higher than expected spending in a category and want to understand why. Example: “Why is our marketing spend higher than planned this month?” Result: Budget Buddy analyzes your marketing line items, identifies the specific campaigns or initiatives driving the increase, and provides detailed breakdowns.

3. Monthly Budget Reviews

Scenario: It’s time for your monthly budget review meeting. Example: “Give me a comprehensive overview of our budget performance this month” Result: Budget Buddy provides category-by-category analysis, highlights variances, identifies trends, and suggests areas for attention.

4. Planning and Forecasting

Scenario: You’re planning next quarter’s budget and want to understand current trends. Example: “Based on our spending patterns, what should we expect for Q4?” Result: Budget Buddy analyzes historical data, identifies seasonal patterns, and provides data-driven projections.

5. Ad-hoc Questions

Scenario: Stakeholders ask unexpected questions about specific expenses. Example: “How much are we spending on software subscriptions across all departments?” Result: Budget Buddy searches through all your line items, identifies software-related expenses, and provides a comprehensive breakdown.

How to Use Budget Buddy

Starting a Conversation

- Click on “Budget Buddy” in your navigation

- Start a new chat or continue an existing conversation

- Simply type your question in natural language

Best Practices for Questions

Be Specific When Needed:

- Good: “Show me our Google Ads spending for this month”

- Better: “Compare our Google Ads spending this month vs. last month”

Use Natural Language:

- “What’s our biggest expense?” ✓

- “SELECT MAX(amount) FROM expenses” ✗

Ask Follow-up Questions:

- Budget Buddy remembers the conversation context

- Build on previous questions for deeper insights

Example Conversations

Quick Check-in:

You: "How are we doing on our budget this month?"

Budget Buddy: "You're currently at 67% budget utilization with $45,000 of your $67,000 monthly budget used. Marketing is your highest category at $18,500, followed by Operations at $12,300. You're tracking well within your targets."Detailed Investigation:

You: "Our marketing spend seems high - what's driving it?"

Budget Buddy: "Let me analyze your marketing expenses... I found 8 active campaigns totaling $18,500. Your Google Ads account for $7,200 (39%), LinkedIn campaigns are $4,100 (22%), and Facebook advertising is $3,800 (21%). The Google Ads increase is due to the Q3 product launch campaign."Features That Make Budget Buddy Special

- 🎯 Context-Aware: Understands your specific budget structure and business

- 💬 Conversational: Communicate in natural language, no technical jargon required

- 🔍 Deep Analysis: Can dive into granular details when you need specifics

- 📊 Real-time Data: Always works with your most current budget information

- 💾 Memory: Remembers your conversations and can reference previous discussions

- ⚡ Fast: Quick responses for overview questions, detailed analysis when needed

- 🔒 Secure: Only accesses data you have permission to see

Getting Started

- Navigate to Budget Buddy from your main dashboard

- Start with a simple question like “What’s my budget status?”

- Explore with follow-up questions based on the initial response

- Save important insights by keeping the chat for future reference

- Try different types of questions to discover Budget Buddy’s full capabilities

Budget Buddy is designed to be your go-to resource for all budget-related questions. Whether you need a quick status update or deep financial analysis, it’s always ready to help you make informed financial decisions.